Editor’s note: Former President Benigno “Noynoy” Aquino III’s passing on June 24, 2021 came as a shock to many Filipinos. The death of Aquino also quickly evoked memories of his administration’s accomplishments and his “social contract with the people,” which covered corruption, infrastructure, economy, poverty, and education, reports Rappler.

As the nation mourns Aquino’s passing, a comparison between his legacy and the widely perceived failings of the Duterte administration is inevitable. To many, the stark differences are all too glaring, especially amid the raging COVID-19 crisis.

Today, millions of jobless and starving Filipinos bear the brunt of the populist president’s heavy-handed tactics that have led to a rise in human rights abuses. They struggle with the dearth of public transportation and health care services, grapple with the challenges of online learning, and are tipped into extreme poverty. The Philippines has ranked 52nd out of 53 economies in a global study that measures the resilience of countries to the COVID-19 pandemic.

Ironically, bureaucratic foot-dragging endangers over ₱18 billion (US$370 million) in unspent funds for the Philippines’ critical coronavirus response programs. These funds are provided for under the Bayanihan to Recover as One Act (Bayanihan 2). Bayanihan in the vernacular refers to a spirit of civic unity and cooperation among Filipinos.

The unused funds will revert to the Philippine treasury when Bayanihan 2 expires on June 30, 2021 — unless President Rodrigo R. Duterte and Senate and Congress leaders convene a special session to extend the Act until December 31, 2021. This was the urgent appeal made by 48 civil society groups, led by Citizens’ Budget Tracker, on June 18, 2021.

The appeal was followed by a forum hosted by the Move as One Coalition on June 25, 2021. The Coalition consists of 140 civil society organizations advocating sustainable mobility for all Filipinos. During the forum, Filomeno S. Sta. Ana III highlighted how misaligned public spending and timid fiscal policy are now taking a toll on the government’s handling of the pandemic.

The respected economist urged Duterte to emulate the example of his predecessor “PNoy” — a portmanteau for President and his nickname Noynoy — who played a key role in pushing for the landmark Sin Tax Reform Act in 2012 alongside other breakthrough policies.

Let me begin by giving a short tribute to the late President Benigno S. Aquino III, fondly known as PNoy. Honoring PNoy is relevant to the issue at hand.

Early in PNoy’s term, his administration faced a serious fiscal problem, which it inherited from the Gloria Arroyo administration. Increasing taxes was necessary, and the best option was to reform the sin tax law. It was a hard reform in the face of a strong lobby that captured many politicians in the House and in the Senate.

At first, a hardheaded PNoy — he was known for his stubbornness — turned down the option. He argued that what he promised to the people during the election campaign was no new taxes. Rather than new taxes, he would improve tax collection, which was insufficient to address the fiscal problem.

One year after, PNoy saw the light. The advice given to him, that the sin tax was not a new tax but a restructuring of a weak tax system, convinced him. He then made the sin tax priority legislation. He did not hesitate to use his political capital and political will to pass the sin tax bill. The rest is history. The 2012 sin tax law broadened the fiscal space, generated revenues for health, and created the momentum for growth and further tax reforms. We thank PNoy for this historically significant victory.

The late President Aquino used political will to push for the landmark Sin Tax Reform Act of 2012. The law led many Filipinos to kick the deadly habit and served as the playbook for the passage of comprehensive tax reforms in the country.

Today we face a similar situation. We likewise have a fiscal problem. But the problem is about the woefully inadequate spending for health and relief amid an uncontained pandemic. This time, it is an imperative, an absolute necessity, to spend big and ensure that the spending is responsive to flattening the pandemic. Containing the pandemic in turn facilitates economic recovery.

Sadly, this is not happening. The executive branch is capping its spending. And the 2021 budget is not a budget that meets the health objective. Let me explain both.

Finance Secretary Carlos Dominguez made a pronouncement that the government’s ceiling for borrowing is at 60% of GDP. In times of economic slowdown (and ours is a deep recession), the counter-cyclical policy of high deficit spending is justified. The idea is to bridge the output gap through government spending, in a situation where private consumption and investments are down.

But our situation is not just about filling the output gap; we have to spend for the health and relief of our people. We need spending for an effective pandemic response, relief, and stimulus.

In this light, does it make sense to cap government borrowing to 60% of GDP? What we know is that the 60% benchmark is a European Union (EU) debt indicator enshrined in its Stability and Growth Pact. This benchmark applies during normal times. But the current situation is far from normal. Furthermore, the EU’s fiscal and monetary parameters have been criticized as conservative. Even before the pandemic, EU members as a whole breached the 60% benchmark. (It was 77.5% by the end of the fourth quarter of 2019.)

So why should the Philippines, a developing country, tie itself to a conservative EU benchmark that applies to advanced economies during normal conditions? Here’s the thing: During the pandemic, the government borrowing of EU members had shot up to 90.7% of GDP.

A proper comparison is between the Philippines and similarly situated emerging market economies. In this regard, we exhibit conservatism. Based on the data from the International Monetary Fund’s (IMF) April 2021 Fiscal Monitor, the average gross debt position of a selection of emerging market and middle-income economies is 65.07% of GDP. The Philippine figure is 51.88%.

Moreover, we argue that Philippine government borrowing can even exceed the average 65% of GDP because we are creditworthy. Credit rating agencies have given us an investment-grade rating, thanks to the series of tax reforms. That means financial institutions will be willing to lend money to us at lower interest rates to boot. The idea behind securing a good credit rating is to use it, when needed.

The credit rating agencies say we can borrow more. So does the IMF. So does the World Bank. So does a chorus of Filipino economists. Enough said.

We tackle the second problem: a budget that is not responsive to saving lives, protecting health, and giving relief. The original 2021 budget suffered from a transfer of funds originally intended for disaster funds, health, pension, and farm-to-market roads, among others, to the pork barrel of congressmen, amounting to approximately ₱240 billion (US$4.9 billion). A veteran legislator described this as “midnight insertions.”

On the other hand, the appropriated budget for vaccination was a measly amount of ₱2.5 billion (US$51 million), which would partly explain the late purchase of sufficient vaccines The General Appropriations Act identified funding for vaccines amounting to ₱2.5 billion, but ₱70 billion (US$1.4 billion) constituted “unprogrammed appropriations,” which eventually got funded by multilateral loans. Bayanihan 2, an act that provided additional funding for the pandemic response, allocated ₱10 billion (US$205 million) for vaccination.

In a word, budgeting for the vaccine program at the onset was anemic, resulting in delayed and inadequate vaccination. The budget for testing, contact tracing, and related interventions to contain the virus was insufficient. The allocation for ayuda (cash aid from the government) vanished.

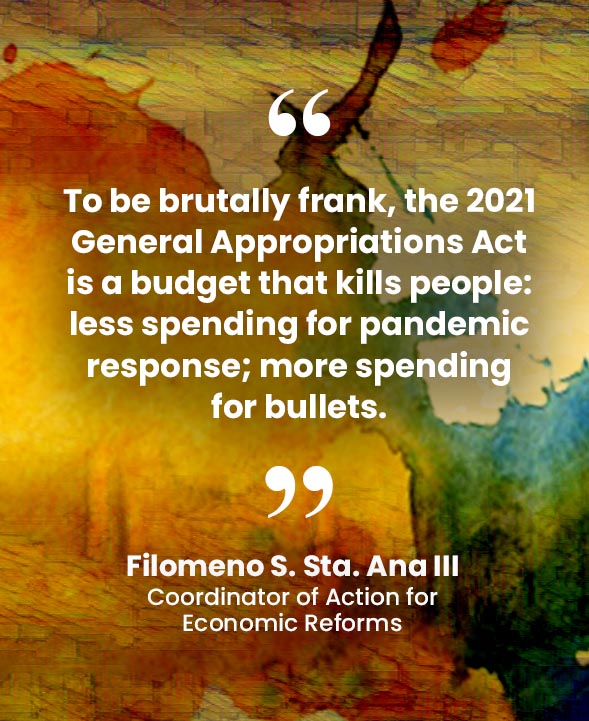

Furthermore, the budget contained other questionable items like the abnormally high allocation for special counter-insurgency (₱19 billion, or US$390 million) and intelligence and confidential expenses (₱4.5 billion, or US$92 million), which accounted for more than half of the total 2021 budget for the Office of the President. To be brutally frank, the 2021 General Appropriations Act is a budget that kills people: less spending for pandemic response; more spending for bullets.

If the Philippine government would want to rectify these errors, it has to do two things:

- increase government spending that prioritizes health, social protection, and job preservation; and

- do an inter-sectoral budget reallocation that will reflect the priorities for health, social relief, and job protection.

We do hope that President Rodrigo R. Duterte will say, “The buck stops here.” That he will make the hard decisions and be responsible and accountable for the decisions.

This brings us back to my introduction, the tribute to PNoy. One way that President Duterte could honor PNoy is to do what PNoy did in addressing the fiscal problem 10 years ago. Exercise leadership, use political capital, and impose political will to have a pro-health, pro-relief, pro-jobs budget for the remaining year of his term. ●

Filomeno S. Sta. Ana III is a Filipino economist and coordinator of Action for Economic Reforms, a public interest organization that conducts policy analysis and advocacy on key economic issues.